Late payments are the bane of your sales team’s existence, but it’s also a reality of doing business. Clients get busy, distracted, or simply miss your invoice as their inbox fills up. They don’t always realize the amount of pressure that their late payment places on the sales department. With 93% of companies experiencing late payments, it’s something that can’t be avoided but should be prepared for.

In this article, we’ll look at how to write a reminder email for payment to ensure that payments are made and that your relationship with the client stays intact. Keep reading to learn how to remind a client to pay you.

What Is the Goal of a Payment Reminder Email?

Life gets busy, and most of us have been guilty of paying an invoice late at some point. While this may not seem so serious to us, it can directly affect the business we’re supporting. Not only does it affect the salesperson’s commission and sales performance, but the business as a whole relies on a steady cash flow.

Often, we don’t want to send a payment reminder because it feels intrusive. However, it’s an essential part of ensuring that your clients pay on time and keep the business moving forward. By sending a gentle reminder for payment, you can still be professional and maintain a good relationship with your client without feeling that you’re spamming them.

The goal of a payment reminder email is exactly that, reminding the client of payments that are due, as well as notifying them of any late fees, penalties, or offering support.

Payment Reminders Timeline – When to Send Reminder Emails?

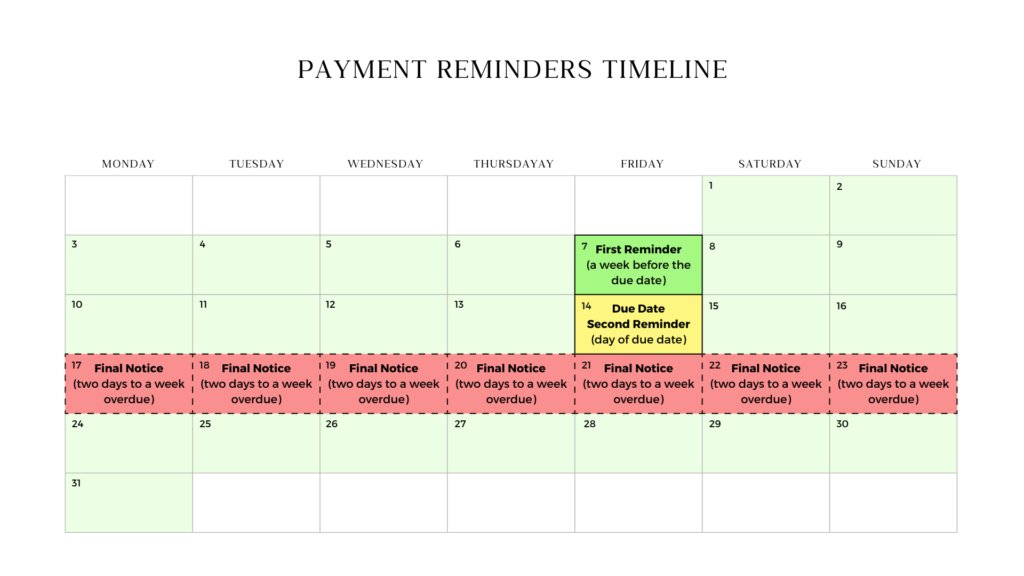

Following up on payments that are late is often time-consuming and financially or emotionally draining. As such, having a strategy and timeline in place will help to make this process less tedious and will ensure that no late payments fall through the cracks. Part of setting up this strategy is knowing when to send a reminder email. Let’s take a look at the proposed timeline for sending a reminder email for payment.

First Reminder – One Week Before the Due Date

Your first payment reminder message should be sent a week before the due date. This should be a friendly payment reminder, and that should be reflected in the tone of your email. Reminding the client before the due date is a common courtesy and also provides them with enough time to ask any questions or get clarification if needed.

Second Reminder – Day of Due Date

If you haven’t received the payment after your first email and the due date has come, you should follow up again. While the follow-up should still be a friendly payment reminder email, it also needs to be more assertive than the first one. In this email, you can clarify any late fees or penalties. More importantly, you should offer any assistance in case the client has issues. It’s also a good idea to consider calling the client directly or sending a physical payment reminder letter at this point.

Final Notice – Two Days to a Week Overdue

If you still haven’t received payment after the due date has gone, it’s time to send the final payment reminder email. This email can be sent between two days and a week after the due date for payment. This email should be formal and the most assertive of all three. It must clearly state the consequences of non-payment, such as legal action or debt collection. Depending on your business, this might also be the time to consider involving a lawyer or debt collection agency.

Tips and Best Practices for Writing Payment Reminders

Sending reminders for payment isn’t a fun task. However, if you have a solid strategy and a few tips to ensure that the emails you send are professional and effective, it can make the task easier. Here are a few recommendations to keep in mind when it comes to following up on late payments.

Check that the client received the invoice

Accidents happen, and all it takes is one busy day, and you could forget to send the invoice. As such, before you start sending an invoice payment reminder email, make sure that you sent the invoice. Better yet, look at using an email tool like the Free Email Tracker for Gmail extension that allows you to see if the client opened the email. This way, you’ll know for sure that they received the invoice.

Attach the invoice to each follow-up email

It’s also a good idea to attach the invoice to each payment reminder that you send. This will make it easier for the client to get to the invoice rather than searching through their inbox. You want to make it as easy as possible for your clients to make the payment.

Don’t assume the worst from your customers

It’s easy to assume that when a client doesn’t make a payment, they’re taking a chance. It’s easy to take it personally and start to assume the worst of your client. However, the reality is that in most cases, they probably just forgot or got distracted by other things. Don’t ruin your relationship with a client because you made an assumption. Remember, building a relationship takes time, and you don’t want to waste that time by making an incorrect assumption.

Provide your client with options

Always double-check that the information provided in your email is correct, especially related to the payment methods. While this should be correct if you use a template for your invoices, it never hurts to look. If a client hasn’t made a payment and you know the details are correct, it could be that they’re struggling to make the payment and could benefit from you providing them with some more payment options.

Remain polite, but firm

You must remain polite in any correspondence with clients, whether it’s appointment confirmation, payment reminder, or response to customer feedback. It’s best to stick to sending a friendly reminder email so that you don’t alienate and possibly lose the client. That being said, you should still remain firm and assertive when sending these reminders. After all, you’ve delivered a service and deserve to get paid for it.

Time your follow-up emails right

Timing is everything when you send emails, especially important ones like payment reminders. Sending these emails late at night or over the weekend could mean that they get lost in the client’s inbox. As such, you should be mindful of the best times to send follow-up emails. Tuesdays during business hours are considered the best time for sending important emails, followed by Wednesdays and Thursdays. Try to avoid sending emails on Monday or Friday and especially over weekends.

Payment Reminder Email Format

As with most professional emails, there’s a specific payment reminder email format that should be followed to ensure the best results. Here’s a suggested format to keep in mind when crafting these emails.

The Subject Line

The subject line is the first thing your client will see. It must be concise, clear, and to the point. It’s a good idea to include the invoice or order number directly in the subject line wherever possible to make it easy for the client.

Body of the Email

The body of your email should start with a friendly greeting. No need to make it too formal, as a simple ‘Hello’ or ‘Dear’ should suffice. The body of your email also shouldn’t be too long. If you add too much content and waffle on about other things, your client might get distracted from the actual goal of the email, which is to make payment. Keep it short and sweet; usually, between 50 – 100 words is enough. Remember to include any important information, such as the invoice number, balance due, and due date, along with important company details and contact information.

The Sign-Off

Conclude your email with a friendly salutation such as ‘All the best’ or ‘Friendly greetings.’ It’s important that you follow the salutation with your name and professional email signature. A client is more inclined to make a payment if they have a personal connection with the salesperson.

Payment Reminder Email Templates

There’s no need for you to write each follow-up email from scratch. In fact, that opens you up to user errors creeping in and important information being missed. As such, using a payment reminder email template is recommended to keep all your messages uniform and ensure they contain the required information each time. Let’s take a look at a few examples to help get you started.

Gentle Reminder

A gentle reminder email is usually sent about a week before the due date of the invoice. This is just to remind the client of the payment that’s due and provide them with any support or information they may be lacking. Here’s a friendly payment reminder example:

Early/Late Reminder

This payment reminder message template is best sent on the due date or immediately following it. For best results, it shouldn’t be sent more than five days after the due date. In this email, you should still be friendly, but with the call to action for the client to make the payment should be clear. You can also include the different payment methods you accept.

Late Late Reminder

This payment reminder email sample should be used when you haven’t received the payment a week after it was due. While the email still remains cordial, it’s the most assertive of all. You should include all the different payment methods you accept once more. This is also the time to remind the client if there are any late fees or penalties for not paying on time.

Final Thoughts

Sending a payment reminder may not be the best part of a business, but it’s essential. By having a strategy in place on how to approach this process, you can distance yourself and still get the results your business needs.

To simplify the process even more and keep track of when to send follow-ups, you can use a CRM solution like InboxCRM Chrome extension by PandaDoc that works directly in your Gmail browser.